Perhaps the single most important concept in the world of customer engagement is customer lifetime value (LTV) – a customer’s total spend with a brand over time. The calculation is straightforward:

Customer Lifetime Value (LTV) =

(# Purchases / Year) x ($ Average Check Size) x (Years before Churning)

But while the concept is simple, incorporating it into your marketing strategy may require un-learning some common – but misguided – marketing wisdom. Most marketers would agree that driving customer revenue is fundamental to growing their businesses – and they would be right. But in pursuing growth, marketing teams often focus exclusively on new customer acquisition. After all, more customers should equal more revenue. Tactics might include paid advertising, social media campaigns, and first-visit freebies.

But these marketers are overlooking two key insights: dedicating resources to acquiring new customers is both expensive and difficult. Research shows that the probability of successfully converting a new customer is between 5% and 20%; for existing customers, the probability of incentivizing an additional purchase skyrockets to 60% – 70%. Not to mention the cost; acquiring new customers can be 6 to 7 times more expensive than retaining an existing customer. These data points may not shock you – even so, the majority of marketers focus primarily on acquisition. But even when your tactics are effective, and you secure a first visit, you haven’t created a “loyal customer” who will provide a predictable revenue stream. In fact, roughly 70% of first-time guests never return.

This is where building a strategy around customer lifetime value (LTV), rather than acquisition, enters the picture. The objective of a lifetime value-centered strategy is incentivizing incremental purchases (and dollars) for known customers; the method is high-touch, personalized engagement tailored to where customers are in their journey.

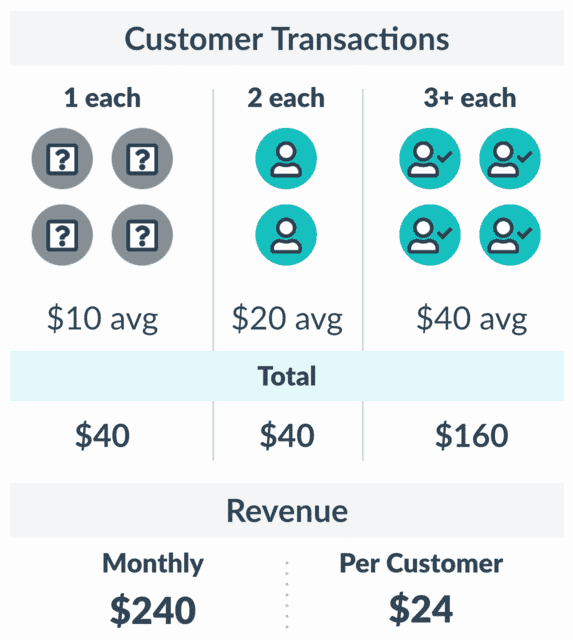

Let’s walk through an example to understand how a lifetime value-focused approach can impact your revenue stream.

Week 1:

Let’s assume you have ten customers. Four of those customers have visited once, and their average check size is $10. Two customers have visited twice, with an average check size of $20. Three of those customers are loyal, visiting three times, with an average check size of $40. In summary:

Monthly Revenue: $240

Average Revenue per Customer: $24

Ten new customers per week make a purchase; no follow-up marketing occurs.

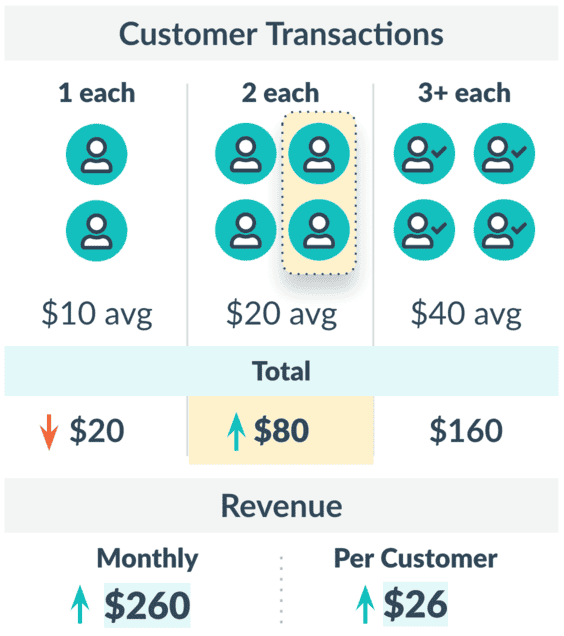

Personalized Engagement: These numbers are okay, but you want to see if you can drive incremental visits and increase spend. So, for the next cohort of new customers in Week 2 (again, let’s assume there are ten), you launch a “bounceback” campaign reminding those ten first-time visitors to return.

Week 2:

Your campaign works! Two more first-time visitors come back. Now, you have four customers visiting twice, and four customers visiting three times. Only two customers don’t come back for another visit. In summary:

Monthly Revenue: $260

Average Revenue per Customer: $26

Bounceback campaign targets trial customers after first purchase.

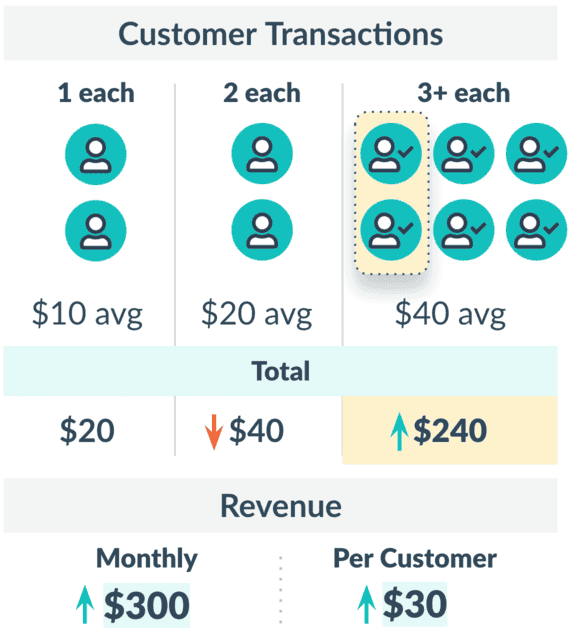

Personalized Engagement: You are pleased with the results so far. The needle has moved. But now you are interested in driving even more visits from your repeat guests. So, for the next batch of guests, you offer a promotion for second-time customers to “buy four times, get the fifth free.”

Week 3:

Of course, you won’t see any lift from those who haven’t made a second visit; they won’t receive the campaign. But you have now moved two more customers into the loyal, three-visit category. Only two customers visit once and two visit twice; six visit three times. And the results prove the impact. In summary:

Monthly Revenue: $300

Average Revenue per Customer: $30

Buy four get the fifth free targets customers after second purchase.

By focusing on driving customer lifetime value (LTV) and improving conversion metrics, you can increase your top-line revenue and per-customer spend, in this example, by 25% in just three weeks! The long-term impact can be even more drastic once you experiment, validate, and then automate outreach for each new cohort of customers – increasing retention by 5% can bump profitability by as much as 95%. The path to surviving and thriving in an increasingly competitive environment is ensuring a robust revenue stream and loyal, engaged customers: and customer lifetime value (LTV) is the guiding light that shows you the way.

To learn more about how Thanx can help you implement a customer lifetime value (LTV) strategy that impacts your bottom line through meaningful guest engagement, schedule a demo today.